AI

Insurance Chatbot Example Demonstrates Increased Sales Conversions of over 11%

Think of the many different ways that customers interact across your business and discover how an AI assistant increases sales conversion, lowers costs, automates customer onboarding, or reduces churn.

Take the example of the insurance industry. Whether it’s requesting an insurance quote, making an insurance claim, renewing a policy, setting up an appointment with an insurance agent, or onboarding new policyholders, Digital Assistants are revolutionizing how insurance firms communicate with and conduct business with their clients.

As consumers communicate across multiple digital channels, from the web to email, SMS, social, mobile apps, and messaging, chatbots are meeting them on their time and in their preferred channel. Here’s a real-world insurance example, based on the AA Ireland, demonstrating how a chatbot increases sales when done right.

An Insurance Case Study:

1. The AA Chooses a Chatbot to Increase Sales Conversion Rates on Quotes

One of the biggest firms in Ireland offering online car, house, travel, and life insurance is The AA Ireland, which was established in 1910 to provide roadside assistance for Irish drivers. Regulatory requirements in the Irish Insurance industry mean that home and car insurance policies have to be renewed every year and the insurance company must send a renewal notice at least 15 days before a policyholder’s renewal date. This gives customers the chance to shop around for the best policy and request new insurance quotes. Naturally, this leads to a competitive marketplace where customers can switch easily if they find a better offer or if they are dissatisfied with their existing provider.

Hence, when you visit insurance websites or mobile apps, a Quote button and attractive promotional offers are designed to attract prospective customers.

In a highly competitive market like insurance, the cost of digital advertising is high. In fact, the term “insurance” is one of the most expensive keywords that can be bid on through Google advertising. To make the most of their investment in digital lead generation, the AA honed in on how they could improve the rates of conversion on these leads. An AI Assistant seemed like the perfect solution to help customers through the quotation process more smoothly and to handle quotation requests out of office hours.

A lot of companies begin their customer service bot platform use cases but the AA saw sales as a great area to put a bot to work. By guiding and helping a customer through the quotation process and answering their queries along the way, customers can complete the sale online, faster and more easily.

“Increasing sales conversions even by 1% to 2% percent helps to make the business more profitable. The potential to use AI Assistants to improve our conversion rates, while providing operational efficiencies across customer service, was an opportunity we couldn’t ignore.” – Customer Lifecycle Manager, Louise McCormick

The business was passing up a chance to explain how potential customers may lower their quotation by making easy modifications to their insurance application due to the fact there was no other means, outside live chat, to interact with, respond to questions from, and retain clients throughout the quote process. Due to unanticipated surges in client demand or requests made outside of regular business hours, the AA was missing a lot of live conversations.

2. How the AA Implemented their Sales Bot

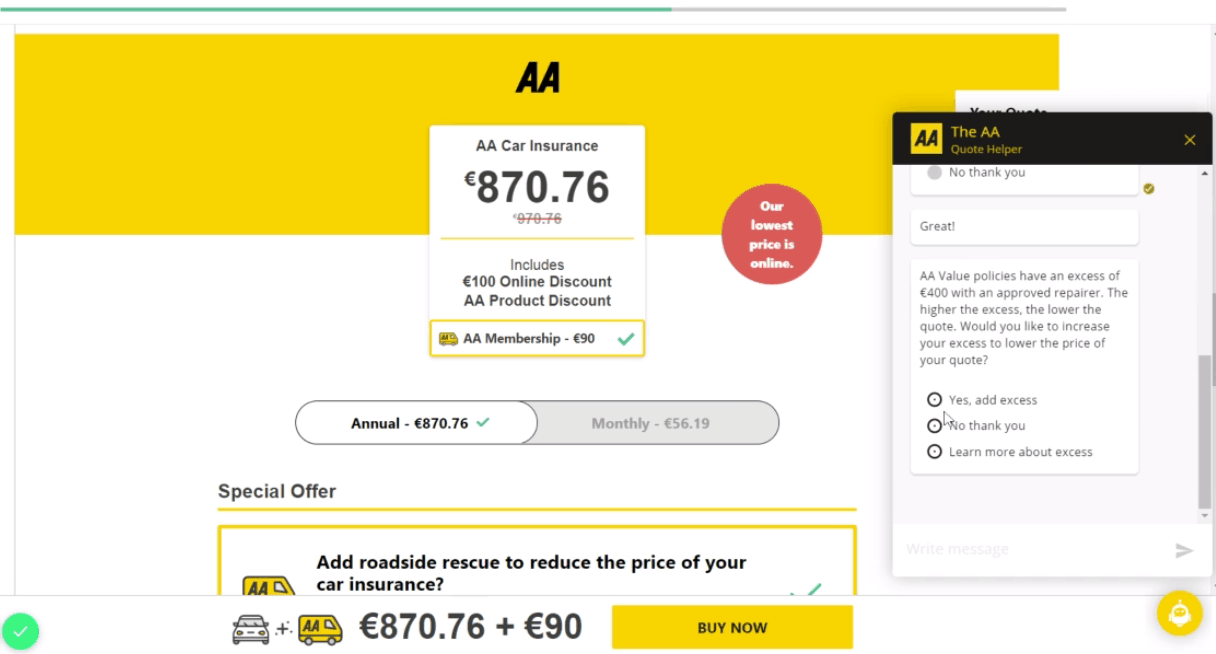

These business requirements gave rise to the concept for Quote Bot. It was created to help customers get the right level of cover and price by interpreting quote details and making personalized recommendations. It does this by directing users to the appropriate page location and letting them interact with the buttons on that page to make necessary changes.

The bot is integrated with Zendesk, the live chat program used by the AA, so that if a potential client requires more assistance, the interaction is smoothly switched to human chat. If the need for more help is made outside of business hours, the bot will arrange a callback.

3. How an Insurance AI Assistant increases Sales Conversion Rates and is launched in 12 weeks

It took only 12 weeks, from the selection of the ServisBOT bot AI platform to the implementation of the Quote Bot. Shortly after launching the AI assistant, the AA saw an 11% increase in quote conversions just by having the bot engage when the contact center was closed. Since its launch in November 2018, the sales conversion rate has risen from this.

In an industry that often competes on price, the application of a well-conceived quote bot shows that by improving the customer experience through making insurance quotations more accessible, convenient, and transparent, the business can reap the rewards of better conversion rates. Just watch this video clip and hear the story:

But, as we witness in many of our client engagements, there are always multiple benefits to both a customer and the business. In the case of the AA, customer self-service and out-of-hours access improved. This resulted in a 40% reduction in agent handling times of customers that had already interacted with the bot. Missed chats dramatically decreased too as the bot intercepted incoming customers when the contact center was busy. This led to reduced pressure on the agents, leading to higher agent satisfaction. And because the bot handles routine quotation interactions and hands-off more complicated sales to the agents, the agent productivity has risen. It’s a win-win.

Listen to our webinar to learn more about how you can keep customers engaged in pre- and post-quote stages and drive higher completion and conversion rates. Featuring the AA Story and a Bot Demo, learn how by deploying AI Digital Assistant you can also:

- Keep users more engaged in the quote-to-sale process and drive higher conversions

- Tackle the problem of dropped users by using a bot to proactively re-engage with them

- Offer customized quotes that deliver a more personalized experience

- Achieve higher productivity and lower costs across your customer acquisition cycle

LISTEN TO THE WEBINAR : Maximize Sales Conversions using AI Bots in Quotation Journeys.

Conversational AI Insurance Bots: From Customer Conversions to Customer Onboarding, Service, Renewals and much more!

Changing customer demographics and expectations, increased competition from new digitally native Insurtech players and a fast-changing technology landscape has placed pressure on the insurance sector to change their clunky business models and processes, resource-intensive customer relationship practices, and inflexible legacy systems. One of the most promising technologies to help them in their transformation is Artificial Intelligence (AI).

At ServisBOT, we are seeing the insurance sector embrace chatbot solutions for a range of different use cases and to achieve different business objectives. The AA started out with a Quote bot since converting incoming leads was a priority but other insurance clients started their bot journey with other goals in mind, for example, streamlining the onboarding of new customers, improving customer retention through more efficient renewals engagements, or updating customer policy changes more easily. It doesn’t matter where you start with a chatbot. The main driver has to be the business need and where a chatbot can have a significant business impact. The rest follows.

The example of the AA is a good one to encourage any insurance provider to prioritize the bot use cases, based on business objectives and the potential for positive impacts. Initial bots don’t have to be complicated but they need to be effective. The AA spent their time analyzing customer chat scripts across email, live chat, and other customer conversations so that they could be sure that when the bot was launched that it could provide consistent, high-quality answers to queries. They wanted the customer to have an experience that both reflected the AA brand and fulfilled their needs. Once the customer lifecycle team was armed with this information they were able to pretty much create the bot themselves using the tooling available from the ServisBOT platform with assistance provided by ServisBOT experts when needed.

This exercise and the impressive results they achieved has spurred the company on to launch and plan a range of more chatbots for different customer interaction points. This is typically the case, one well-conceived and successful bot experience motivates a company to roll out many more chatbots.

Customer Experience and the Adoption of Enterprise Chatbots

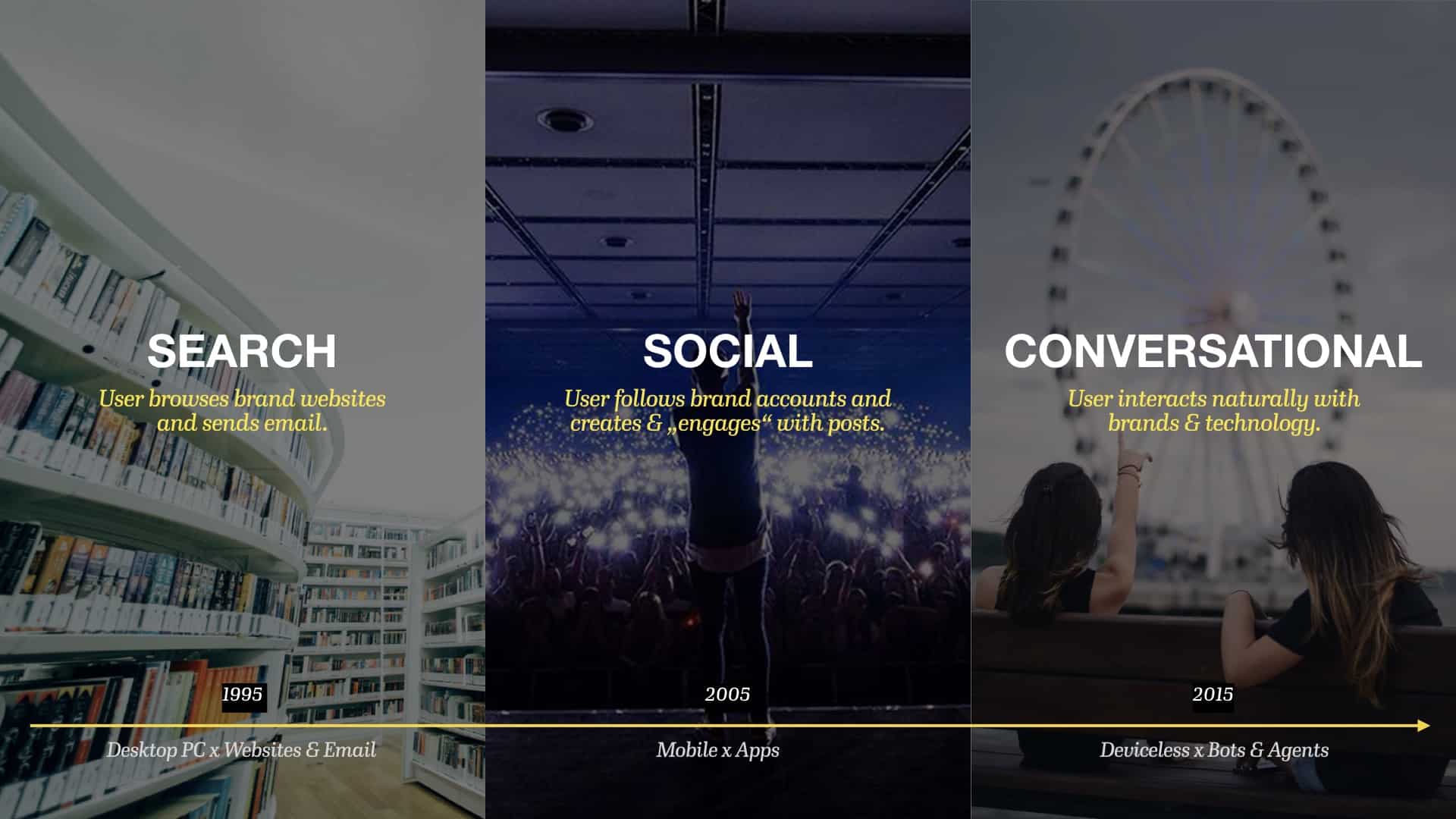

Chatbots are not new. After all, the first chatbot, ELIZA, was created over 50 years ago. So why are they suddenly so important. There are a number of factors at play here, one of which is the evolution of different interfaces that allow us to interact and search for information. This image helps explain how, over time, we have moved from using websites and email to engage and search, to the emergence of mobile and social media where we can interact, search, and share while on-the-go, and now to conversational interfaces where we can interact, transact and search using natural language powered by chatbots and available 24/7.

Source: https://becominghuman.ai/brands-get-a-voice-the-rise-of-conversational-interfaces-5853f952e75a

The shift in graphical interfaces to conversational ones is monumental. Conversation by its nature is more fluid and natural than the structured web forms and data fields we are used to from graphical user interfaces. As speech recognition and natural language processing technologies mature and improve, chatbots become more intelligent and capable of understanding exactly what a customer wants and responding accordingly. This has given rise to a steep increase in the adoption of enterprise chatbots. In the case of the AA, 80% of customers that clicked on the bot continued to interact with it. So not only are businesses embracing conversational engagement, customers are too.

Put Insurance Bots to Work Across Your Business

It is no longer good enough to expect people to engage nine-to-five with live chat or via voice with contact center agents. Consumers are demanding the exceptional experience that they get from providers in other areas of their life and are bringing these expectations to their insurance needs. They want to interact on their time and in the channels that they have adopted – this can be voice speakers, messaging apps, SMS, web or mobile apps, as well as the more traditional email, live chat, and phone channels. Besides wanting things done instantly, they also demand greater transparency.

While the price is an important part of purchasing an insurance policy, it is also about the experience that the customer has. Has the customer got all the policy information at their fingertips or is it hidden in the small print? How responsive is their insurance provider when they have a claim? It is the sum of their interactions that determine their overall experience and the more positive interactions they have the more likely it is to create increased loyalty and retention.

For more insights into how chatbots can transform how you engage with your insurance customers you may be interested in the following resources:

To conclude, here’s a short video clip that demonstrates how a chatbot adds value for Insurance providers.

Download our Insurance Chatbot eBook to learn more about different bot use cases.