Putting A Digital Assistant in Front of a New Live Chat System

Motivated by the results and the learnings from the Forbearance Bot that was launched to help distressed borrowers when COVID-19 hit, Cenlar opted to create a second AI bot using ServisBOT’s reusable, scalable technology.

For this project, they wanted to replace their legacy live chat system with a more modern one and make it more accessible to borrowers. Since this would increase the incoming chats to their live chat agents, they decided to put a bot at the forefront so that borrowers could choose to have common requests dealt with immediately by the bot.

“Agent productivity increased as they were able to respond to more targeted queries that only live agents can effectively handle and should handle.”

Shanth Ananthuni, Director of Digital Transformation, Cenlar FSB

Replacing the Live Chat System

Cenlar wanted to ease the burden on live chat agents while still meeting increased traffic from borrower inquiries. For this project, the company decided to replace its legacy live chat system. With ServisBOT’s help, they chose a more efficient live chat interface that would be launched within the borrower portal, making it more visible and intuitive to borrowers logged into their account.

With approximately 2 million borrowers visiting the website, and an increase in traffic to their borrower portal, a heavier demand on their team of live chat agents was inevitable. Incorporating a bot in front of a modern live chat solution was critical to being able to automate common requests while offering a warm handover to a live chat agent when necessary. This enabled agents to focus on more unique or complex borrower issues.

Creating Borrower Bot

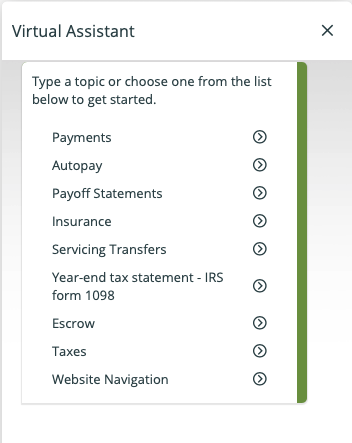

Typical requests handled by the bot are related to how to make payments, set up autopay, learn about loan transfers, request a 1098 tax form, escrow queries, and more. These selections are presented in a menu, where the borrower can select an option or choose to type a question via free-form text in the message area.

For issues not handled by the bot, the borrower is given an option to chat with an agent via live chat. If they choose to do so, their authenticated loan number and name are handed over to the agent so they have the context to proceed and help the borrower.

“Choosing to have their queries resolved via self-service and not go to live chat leads us to believe that borrowers are satisfied with the bot. Another indicator of borrower satisfaction with the bot is that when we added additional intents in order to better anticipate borrower needs, bot engagement has grown.”

Lou Sigillo, Senior Vice President for Contact Center Operations, Cenlar FSB

Less Agent Pressure, Higher Borrower Satisfaction

During office hours, Cenlar is experiencing a 75% containment rate with only one out of four requests passed to the live agents. The borrower bot was launched at a time of the year when call volumes generally increase, primarily due to tax season, on top of the demand related to COVID-19. This has really helped take the pressure off agents and is especially valuable in assisting borrowers with 1098 tax-oriented help.