Chatbots Deliver Gains for Customers and Agents

Digital Self-Service Enabled by Chatbots

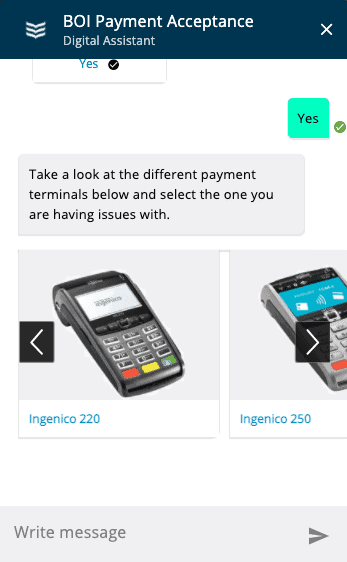

Inbound inquiries to BOIPA’s contact center are increasing as more businesses adopt electronic and contactless payment terminals. While attempting to accept customer payments, merchants may encounter delays. In order to handle questions about payment terminals, questions about payment acceptance, and adjustments to merchant bank accounts, BOIPA wants to offer a straightforward self-service method. A digital assistant, powered by AI, provided the perfect solution.

“We could see technically how the ServisBOT platform works and how easy and seamless it was to make changes to the bots. It was also clear that the platform would allow us to build an intuitive and engaging user experience.”

Jennifer Doyle, EVO (BOIPA), Head of Digital Platforms

A Chatbot TroubleShoots Terminal Issues & Assists with Merchants’ Account Changes

Similar queries from merchants regarding their payment terminals or updating their bank account information are common. In particular, if they were experiencing trouble using their terminal and unable to make payments, BOIPA didn’t want them to have to wait. They made the decision to create a Terminal Troubleshooter Bot that would instruct merchants on how to swiftly fix technical problems and offer extra after-hours help, relieving the burden on contact center workers and lowering the cost to serve. To help with processing changes to a merchant’s bank accounts, Terminal Troubleshooter bot also has Bank Account Change functionality.

“We sent ServisBOT some high-level data during the sales process, and within 3 days they put out a demo bot that impressed us. They demonstrated to us how they could provide us flexible chatbot solutions that would genuinely benefit our clients, demonstrating how they truly understood our business difficulties and what we were attempting to accomplish.”

Terminal Troubleshooter Bot Handles Sensitive Data

The Terminal Troubleshooter Bot seamlessly integrates with BOIPA’s back-office systems, providing an interface for customers to upload electronic signatures and other personal documents without the bot itself storing any sensitive data. Designing the bot to pass customer data through to BOIPA without retaining it was vital for meeting the organisation’s strict security policies and industry rules and regulations around data handling.

The Bank Account Change feature of the bot is designed in such a way that customers cannot proceed to the next stage of the process unless they have provided a signature and uploaded the required documents. Contact centre agents sometimes forget to ask for proof of banking documentation while they’re on the phone, this can result in a three- or four-step process that can take up to three days.

“This demonstrates the flexibility of the platform, it allows us to transform customer engagement while still adhering to the rules and policies of our organisation.”

A Call Deflection Solution Demonstrates Agility During Pandemic

Just as BOIPA was about to launch the Terminal Troubleshooter Bot pilot, COVID-19 hit and many of the businesses that use BOIPA payment terminals were forced to close their physical premises. A call deflection solution was more urgently required so that they could handle increased call volumes to customer service agents that were now working remotely.

BOIPA was able to integrate ServisBOT’s platform with its Avaya IVR system and Intercom Live Chat and deploy a call deflection solution within a matter of days. An additional feature was built into the IVR that allowed merchants to divert to a chatbot if they didn’t want to wait to speak to an agent. They would then receive an SMS with a link to an FAQ bot. This bot was designed to provide answers to COVID-related and other top customer queries, with the ability to seamlessly hand over to a human via live chat if the customer had other queries, not within the scope of the bot.

“The bot was transformational.”

“The platform gave us the flexibility to make changes within 24 hours if need be. A lot of providers claim that, but with ServisBOT we really could. It was great to have the ability to request changes and have a team that could deliver at the click of your fingers.”

Achieving Lower Operating Costs and Higher Productivity

Within six months of launching the call deflection solution, ca. 17% of calls had been deflected to the bot. With the average cost to handle each inbound call estimated at €1.75, having the bots working together to help automate business processes significantly reduces operating costs. Bot engagement was also high – of those that clicked on the bot 70% engaged with it.

When it comes to merchants making account changes using the bot, the true value of a smoother and more efficient journey is borne out in the data. 100% of merchants using the bot for bank account changes attach proof of banking in the first interaction, compared to just 40% of those who request bank account changes via email. Of that percentage, just 20% of emailed documents are correct, and, as a result, emailed bank account change requests require at least twice as many interactions with customer service agents.

About ServisBOT Conversational AI Platform

ServisBOT provides a Conversational AI platform that enables financial service and banking providers to easily create chatbot solutions for many different use cases, automating key interactions across the lifecycle using AI. The platform gives business users and enterprise developers the tools to get digital AI assistant solutions to market faster.